UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ |

|

| Definitive |

☐ |

|

| Soliciting Material Pursuant to §240.14a-12 |

Table Trac, Inc. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement if other than the Registrant) |

|

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required. |

☐ | Fee paid previously with preliminary |

☐ | Fee computed on table |

TABLE TRAC, INC.

6101 Baker Road, Suite 206

Minnetonka, Minnesota 55345

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD SEPTEMBER 14, 2022MAY 15, 2024

TO THE STOCKHOLDERS OF TABLE TRAC, INC.:

Please take notice that the Annual Meeting of Stockholders (the “Annual Meeting”) of Table Trac, Inc. (the “Company”) will be held, pursuant to due call by the Board of Directors, on Wednesday, September 14, 2022,May 15, 2024, at 9:30a.m., at HILTON GARDEN INN 6330 Point Chase Eden Prairie, Minnesota 55344 (Crosstown Hwy 62 & Shady Oak Rd.), or at any adjournment or adjournments thereof, for the purpose of considering and taking appropriate action with respect to the following:

1. | The election of three directors to the Company’s Board of Directors; |

2. | The ratification of the appointment of Boulay P.L.L.P. as our independent registered public accounting firm for fiscal |

|

The transaction of any other business as may properly come before the Annual Meeting or any adjournments thereof. |

Pursuant to due action of the Board of Directors, stockholders of record on JULY 28, 2022April 2, 2024 will be entitledentitled to vote at the Annual Meeting or any adjournments thereof.

BECAUSE OF COVID 19 RESTRICTIONS, PENDING THE GOVERNOR’S DECLARATIONS, WE MAY BE LIMITED AS TO THE NUMBER OF ATTENDEES ALLOWED IN THE MEETING ROOM.

By Order of the Board of Directors:

Chad B. Hoehne

| |||

July 19, 2022

April 9, 2024

TABLE TRAC, INC.

6101 Baker Road, Suite 206

Minnetonka, Minnesota 55345

PROXY STATEMENT

20222024 ANNUAL MEETING OF STOCKHOLDERS

to be held on September 14, 2022May 15, 2024

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Table Trac, Inc. (periodically referred to herein as the “Company,” “we,” “our,” “us” and similar terms) for use at the 20222024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Wednesday, September 14, 2022,May 15, 2024, at 9:30 a.m., at HILTON GARDEN INN 6330 Point Chase Eden Prairie, Minnesota 55344 (Crosstown Hwy 62 & Shady Oak Rd.), and any adjournment or postponement thereof, for the purpose of considering and taking appropriate action with respect to the following:

1. | The election of three directors to the Company’s Board of Directors; |

2. | The ratification of the appointment of Boulay P.L.L.P. as our independent registered public accounting firm for fiscal |

|

This Proxy Statement and the enclosed proxy card are first being mailed or given to stockholders on or about August 6, 2022.April 10, 2024.

Proxies and Voting Procedures

Holders of record of our common stock at the close of businessbusiness on July 28, 2022April 2, 2024 (the “record“record date”) will be entitled to attend and vote at the Annual Meeting or any adjournments thereof. There were 4,621,988 shares 4,634,865 shares of our common stock outstanding on the record date. Each share of common stock entitles the holder thereof to one vote upon each matter submitted to a vote of stockholders at the Annual Meeting. A quorum, consisting of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting, must be present in person or represented by proxy before legal action may be taken at the Annual Meeting.

Each proxy returned to the Company will be voted in accordance with the instructions indicated thereon. If no direction is given by a stockholder who returns a properly executed proxy, then the shares will be voted as recommended by the Company’s Board of Directors. If a stockholder abstains from voting on any matter, then the abstention will be counted for purposes of determining whether a quorum is present at the Annual Meeting for the transaction of business as well as shares entitled to vote on that matter. Under Section 320 of the Nevada General Corporation Law (Chapter 78 of the Nevada Revised Statutes), the affirmative vote of the holders of a majority of the total votes cast, in person or represented by proxy at the Annual Meeting and entitled to vote, is required for ratification and approval of each proposal contained in this Proxy Statement, other than the election of directors (Proposal One). For the election of directors, director-nominees are approved upon their receipt of a plurality of votes cast at the meeting. Accordingly, an abstention on any matter (other than the election of directors) will have the same effect as a vote against that matter. In the case of the election of directors (who are elected by a plurality of votes cast), an abstention is the equivalent of simply not casting a vote.

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. Broker non-votes on a matter are counted as present for purposes of establishing a quorum for the Annual Meeting, but are not considered “entitled to vote” on that particular matter. Consequently, broker non-votes generally do not have the same effect as a negative vote on the matter being voted on.

Each stockholder who signs and returns a proxy card in the form enclosed with this Proxy Statement may revoke the proxy at any time prior to its use by giving notice of revocation to our Secretary in writing, in open meeting, or by executing and delivering a new proxy card to our Secretary. Unless revoked, the shares represented by each proxy card will be voted at the Annual Meeting and at any adjournments thereof. A stockholder’s mere presence at the Annual Meeting does not revoke any proxy that the stockholder has previously delivered.

Please note that if you are a beneficial owner of shares registered in the name of your broker, bank, custodian, nominee or other agent (commonly referred to as holding your shares in “street name”), you will have received a voting instruction form with these proxy materials from that organization rather than from the Company. In such a case, you should complete and mail the voting instruction form as instructed by your broker, bank, custodian, nominee or other agent to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker, bank, custodian, nominee or other agent. If you hold your shares in street name and you wish to vote in person at the Annual Meeting, then you must obtain a legal proxy from your broker, bank, custodian, nominee or other agent. To do so, follow the instructions you received with these proxy materials, or contact your broker, bank, custodian, nominee or other agent to request a legal proxy form. You may also request a legal proxy at www.proxyvote.com.www.proxyvote.com.

NOTICE TO BENEFICIAL OWNERS OF SHARES HELD IN BROKER ACCOUNTS:

New York Stock Exchange Rule 452 prohibits NYSE member organizations from giving a proxy to vote with respect to an election of directors (Proposal One) without receiving voting instructions from a beneficial owner. Because NYSE Rule 452 applies to all brokers that are members of the NYSE, this prohibition applies to the Annual Meeting even though our common stock is not listed on the New York Stock Exchange. Therefore, brokers will not be entitled to vote shares at the Annual Meeting without instructions by the beneficial owner of the shares. AS A RESULT, BENEFICIAL OWNERS OF SHARES HELD IN BROKER ACCOUNTS ARE ADVISED THAT, IF THEY DO NOT TIMELY PROVIDE INSTRUCTIONS TO THEIR BROKER, THEIR SHARES WILL NOT BE VOTED IN CONNECTION WITH THESE PROPOSALS.

ELECTION OF DIRECTORS (Proposal One)

The Company’s directors are elected upon a plurality of votes cast. If elected or re-elected, each nominee has consented to serve as a director of the Company, to hold office until the next annual meeting of stockholders or until his successor is elected and shall have qualified. If any director-nominee should withdraw or otherwise become unavailable for reasons not presently known, the proxies that would have otherwise been voted for that director nominee may be voted for a substitute director nominee selected by the Company’s Board of Directors.

Set forth below is information regarding the individuals nominated for election to the Board of Directors, which includes information furnished by them as to their principal occupations for the last five years, certain other directorships held by them, and their ages as of the date of this Proxy Statement:

Chad Hoehne (age 60)62) - Director since 1999

Mr. Hoehne is the Founder, President and CEO of Table Trac, Inc. After graduating from Minnesota State University Mankato earning his BS in Business Administration and Finance, Mr. Hoehne spent 10 years working in management for a Minneapolis-based electronics manufacturing and software company prior to founding Table Trac Inc. in 1995. Mr. Hoehne took his experience in electronic manufacturing and software design and applied those in the area of gaming systems, developing and patenting the first of its kind table games management system (Table Trac) in 1996, and leading the company’s business plan to encompass the entire Casino Management Systems business in all jurisdictions. Table Trac Inc has grown to be licensed in Nevada and 5five other states commercially, 13 countries and dozens of First Nations serving over 200more than 300 casinos.

William Martinez (age 60) 61) – Director Director since 2018

Mr. Martinez has been private contractor for the Department of Justice for the past several years, serving as an expert in homicide investigations and Use of Force. From 2012 to 2016, Mr. Martinez was the Assistant Chief of Police-Chief of Detectives/Major Crimes, for the city of St. Paul. Prior to that, he was the Senior Commander of St. Paul’s Homicide and Robbery Unit. Bill has also been committed to numerous Community Building Initiatives over the years. In addition to his extensive experience in multiple facets of law enforcement, Bill is a skilled leader with strong communication and teaching skills and will be highly effective in developing Table Trac’s organizational and ongoing development vision.

Thomas J. Mertens (age 57)59) – Director since 2018

Mr. Mertens is a graduate of St. John's University with a degree in accounting. He became a Certified Public Accountant in 1990 and a Master Graduate of Rapport Leadership International in 2002. For the past nine years,Since 2013 Tom has been the Chief Financial Officer for the Archdiocese of St.a large non-profit organization serving Minneapolis and Saint Paul, and Minneapolis where he’she developed, implemented and provided oversight of processes, procedures and best practices. Tom was the CFO and Controller for Macquarie Air-Serv Holding Inc. for eight years where he provided expertise and leadership in growing the company's revenues from $60M to $130M mainly through acquisitions. Tom began his career as an auditor for KPMG Peat Marwick in Minneapolis. Tom is a proven leader and will bring that skill and decades of experience to Table Trac's Board of Directors.

The Board of Directors recommends that stockholders vote FOR each of the above-named director-nominees.

EXECUTIVE OFFICERS OF OUR COMPANY

Name and Title | Age | Principal Occupation and Business Experience | ||

Chad Hoehne, Chief Executive Officer, President, Chief Technology Officer | [ | See ‘‘Election of Directors (Proposal One)” — above. | ||

|

|

| ||

Randy Gilbert, Chief Financial Officer, Chief Operation Officer | [ | Mr. Gilbert was appointed as the Company’s Chief Financial Officer on January 8, 2018. On April 1, 2024, Mr. Gilbert was appointed as the Company's Chief Operation Officer. Previously and since September 2015, Mr. Gilbert served as a Principal with Assurance Consulting 3 (AC3) a division of Boeckermann, Grafstrom and Mayer, which provides Sarbanes Oxley and Internal audit services. Prior to that and since 2006, he was a manager with AC3. Additionally, Mr. Gilbert served as the Chief Financial Officer for EVO Transportation & Energy Services, Inc. (formerly called Minn Shares Inc.) from May 2016 to December 2017. Mr. Gilbert has a Bachelor of Accounting B.ACC degree from the University of Minnesota - Duluth and began his Accounting career with KPMG. |

EXECUTIVE COMPENSATION

Summary Compensation Table

The table below summarizes the total compensation paid or earned during the fiscal years ended December 31, 20202023 and 2021.2022.

Name, Principal Position | Salary and Bonus | Stock Awards | Total | ||||||||||

Chad Hoehne, | 2020 | $ | 353,325 | $ | 0 | $ | 353,325 | ||||||

| President, CTO and CEO(1) | 2021 | 285,550 | 48,400 | 333,950 | |||||||||

Robert Siqveland, COO, | 2020 | 130,135 | 0 | 150,093 | |||||||||

| Secretary | 2021 | 123,620 | 48,400 | 172,020 | |||||||||

Randy Gilbert, CFO(2) | 2020 | 215,353 | 0 | 215,353 | |||||||||

Randy Gilbert, CFO | 2021 | 156,060 | 72,600 | 228,660 | |||||||||

Name, Principal Position | Salary and Bonus | Stock Awards | Stock Option Awards | Total | |||||||||||||

Chad Hoehne, President, CTO and CEO(1) | 2023 | $ | 357,000 | $ | 0 | $ | 0 | $ | 357,000 | ||||||||

2022 | 380,814 | 0 | 0 | 380,814 | |||||||||||||

Robert Siqveland, former Secretary and COO(2) | 2023 | 149,000 | 0 | 0 | 149,000 | ||||||||||||

2022 | 155,461 | 43,625 | 0 | 199,086 | |||||||||||||

Randy Gilbert, CFO(3) | 2023 | 241,521 | 61,075 | 0 | 302,596 | ||||||||||||

2022 | 231,167 | 23,500 | 0 | 254,667 | |||||||||||||

(1) | Chad Hoehne was appointed as the Company’s Chief Executive Officer on November 20, 2017. From November 20, 2017 until January 8, 2018, he also served as the interim Chief Financial Officer. |

| (2) | Mr. Siqveland resigned from his positions as Secretary and Chief Operating Officer effective March 31, 2023. |

| Mr. Gilbert was appointed as the Company’s Chief Financial Officer on January 8, |

We do not currently have any employment or change-in-control agreements with any named executives or any other current members of our executive management. As of the date of this Proxy Statement, we do not offer our executive employees any pension, annuity, profit-sharing or similar benefit plans other than insurance and the company 401K.401K plan. Executive compensation is subject to change from time to time concurrent with our requirements and policies as established by the Board of Directors and its Compensation Committee.

Robert Siqveland resigned from his position as Chief Operating Officer and Secretary of the Company, effective March 31, 2023. In connection with his resignation, the Company entered into a letter agreement with Mr. Siqveland on December 15, 2022, agreeing to provide Mr. Siqveland with the following payments and benefits: (i) a severance payment equal to 12 months of his current salary (exclusive of any bonus), payable 75% on April 15, 2023 and 25% on January 15, 2024, subject to continued compliance with Company policies; (ii) accelerated vesting of unvested stock options to purchase 20,000 shares of the Company’s common stock that were awarded to Mr. Siqveland on May 14, 2021, vesting 100% as of December 15, 2022, and extension of the period during which such options remain exercisable to 12 months from March 31, 2023; and (iii) accelerated vesting of 12,500 unvested restricted stock shares that were awarded to Mr. Siqveland on March 25, 2022, vesting 100% as of December 15, 2022.

Outstanding Equity Awards at Fiscal Year End

As of December 31, 2021,2023, our named executives had the following outstanding options to purchase common stock:

Outstanding Equity Awards Table at Fiscal 2021 Year-End | Outstanding Equity Awards Table at Fiscal 2023 Year-End | |||||||||||||||||||||||||||||||||||||||||

Option Awards | Stock Awards | Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||||||

Number of Securities Underlying Unexercised Options (#) |

|

| Number of Shares of | Market Value of Shares of Stock | Number of Securities Underlying Unexercised Options (#) | |||||||||||||||||||||||||||||||||||||

Named Executive | Exercisable | Unexercisable | Option Exercise | Option Expiration Date | Stock that Have Not Vested | that Have Not Vested (1) | Exercisable | Unexercisable | Option Exercise Price | Option Expiration Date | Number of Shares of Stock that Have Not Vested | Market Value of Shares of Stock that Have Not Vested | ||||||||||||||||||||||||||||||

Chad Hoehne | 5,000 | 15,000 | (2) | $ | 2.42 | 5/13/2031 | 0 | $ | 0 | 15,000 | 5,000 | $ | 2.42 | 5/13/2031 | - | $ | - | |||||||||||||||||||||||||

Robert Siqveland | 5,000 | 15,000 | (2) | 2.42 | 5/13/2031 | 0 | 0 | |||||||||||||||||||||||||||||||||||

Randy Gilbert | 7,500 | 22,500 | (2) | 2.42 | 5/13/2031 | 10,000 | (3) | 33,000 | 22,500 | 7,500 | 2.42 | 5/13/2031 | 70,000 | 267,400 | ||||||||||||||||||||||||||||

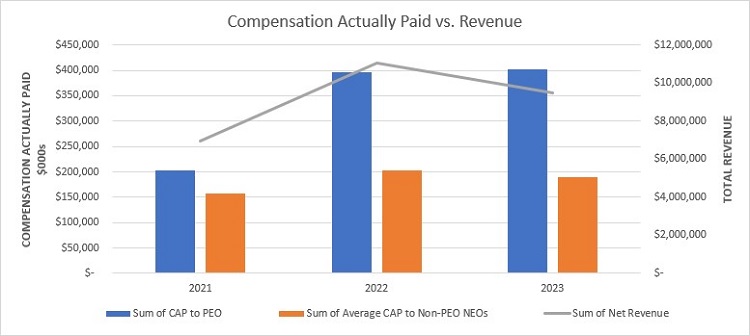

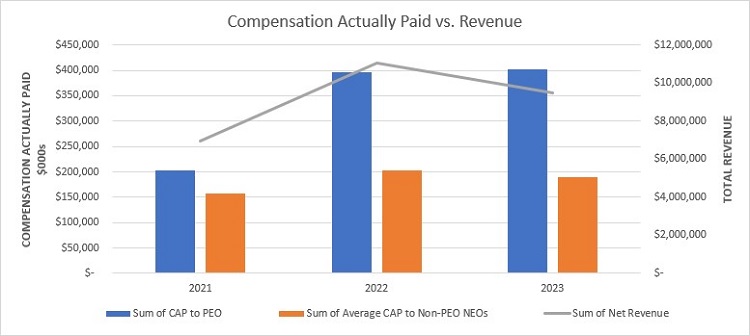

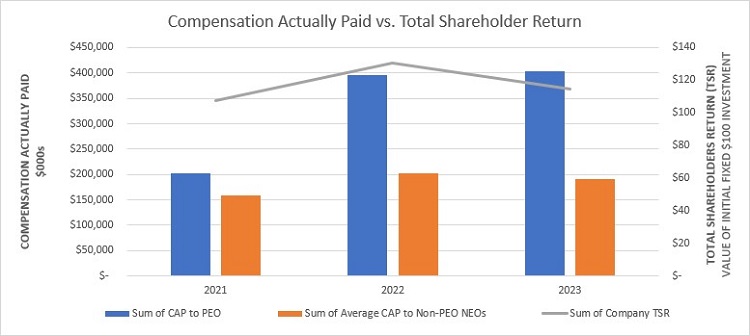

Pay Versus Performance

In accordance with rules adopted by the SEC pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we provide the following disclosure regarding executive compensation for our principal executive officer, or PEO, and Non-PEO named executive officer, or Non-PEO NEO, and Company performance for the years listed below. Our PEO is Chad Hoehne. We have two Non-PEO NEO, which are Randy W. Gilbert, our Chief Financial Officer and Robert Siqveland, our Chief Operating Officer, who retired March 31, 2023.

The Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the years shown:

Year | Summary Compensation for PEO(1) | Compensation actually paid to PEO(2) | Average Summary Compensation Table Total for Non-PEO NEOs (3) | Average Compensation Actually Paid to Non-PEO NEOs(4) | Value of Initial Fixed $100 Investment Based On Total Shareholder return(5) | Net Income(6) | ||||||||||||||||||

2023 | $ | 357,000 | $ | 402,598 | $ | 225,798 | $ | 190,539 | $ | 114.55 | $ | 1,613,005 | ||||||||||||

2022 | 380,814 | 396,550 | 226,877 | 202,283 | 130.81 | 1,624,453 | ||||||||||||||||||

2021 | 333,950 | 238,950 | 200,340 | 157,740 | 107.27 | 1,710,651 | ||||||||||||||||||

(1) | The dollar amounts reported are the amounts of total compensation reported for Mr. Hoehne, our President and Chief Executive Officer, for each corresponding year in the "Total" column of the Summary Compensation Table (SCT). |

(2) | The dollar amounts reported represent the amount of “compensation actually paid” to Mr. Hoehne, computed in accordance with SEC regulations. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Mr. Hoehne during the applicable year. The following adjustments were made to Mr. Hoehne’s total compensation for each year to determine “compensation actually paid” in accordance with SEC regulations. |

Adjustments to Determine Compensation Actually Paid for PEO | 2023 | 2022 | 2021 | |||||||||

Deduction for amounts reported under the “Stock Awards” and "Stock Options Awards" columns in the SCT | $ | 0 | $ | 0 | (48,400 | ) | ||||||

Increase for fair value of awards granted during year that remain unvested as of year end | 0 | 0 | 0 | |||||||||

Increase/deduction for change in fair value from prior year end to current year end of awards granted prior to year that were outstanding and unvested as of year end | (3,050 | ) | (12,696 | ) | 1,800 | |||||||

Increase/deduction for change in fair value from prior year end to vesting date of awards granted prior to year that vested during year | 13,750 | 5,000 | 0 | |||||||||

Increase for dividends paid during the current year | 34,898 | 23,432 | 0 | |||||||||

Total Adjustments | $ | 45,598 | $ | 15,736 | (46,600 | ) | ||||||

Year end fair values were determined based on the same methodology used for grant date fair value purposes. Deferred stock was valued based on the closing stock price on the relevant measurement date. Stock awards under the Table Trac, Inc. 2021 Stock Incentive Plan were valued using a fair value per share determined using a Black-Scholes model run on the relevant measurement date. Following the measurement date, the final dollar amount payout determined by the Compensation Committee and the stock price at that time determined the number of shares issued.

(3) | The dollar amounts reported represent the average of the amounts reported for the NEOs as a group (excluding our PEO) in the “Total” column of the Summary Compensation Table in each applicable year. The NEO included for purposes of calculating the amounts in each applicable year is Randy W. Gilbert, our Chief Financial Officer and Robert Siqveland, our Chief Operation Officer. |

(4) | The dollar amounts reported represent the amount of “compensation actually paid” to the NEOs as a group (excluding our PEO), as computed in accordance with SEC regulations. Again, the NEOs as a group (excluding our PEO) refers to Randy W. Gilbert, our Chief Financial Officer and Robert Siqveland, our Chief Operation Officer. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Mr. Gilbert and Mr. Siqveland during the applicable year. The following adjustments were made to the non-PEO NEO total compensation for each year to determine “compensation actually paid” in accordance with SEC regulations, using the same methodology described above in Note 2: |

Adjustments to Determine Compensation Actually Paid for Non-PEO NEO | 2023 | 2022 | 2021 | |||||||||

Deduction for amounts reported under the “Stock Awards” and "Stock Options Awards" columns in the SCT | $ | (61,075 | ) | (67,125.00 | ) | $ | (121,000 | ) | ||||

Increase for fair value of awards granted during year that remain unvested as of year end | 0 | 0.01 | 0 | |||||||||

Increase/deduction for change in fair value from prior year end to current year end of awards granted prior to year that were outstanding and unvested as of year end | (4,575 | ) | (19,046.27 | ) | 4,500 | |||||||

Increase/deduction for change in fair value from prior year end to vesting date of awards granted prior to year that vested during year | (7,350 | ) | 31,300.00 | 31,300 | ||||||||

Increase for dividends paid during the current year | 2,482 | 5,684.50 | 0 | |||||||||

Total Adjustments | $ | (70,518 | ) | (49,186.76 | ) | $ | (85,200 | ) | ||||

(5) | Cumulative TSR is calculated by dividing the sum of (i) the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and (ii) the difference between our share price at the end and the beginning of the measurement period by our share price at the beginning of the measurement period. We do not use TSR as a performance measure in our executive compensation program. |

(6) | The dollar amounts reported represent the amount of net income reflected in our audited financial statements for the applicable year. We use total revenue as a performance measure in our executive compensation program. |

Relationship Disclosure to Pay Versus Performance Table

In accordance with rules adopted by the SEC pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we provide the following descriptions of the relationships between information presented in the Pay Versus Performance table.

Compensation Actually Paid and Performance Measures

The charts below show, for the past three years, the relationship between the compensation actually paid (CAP) to our PEO and the compensation actually paid (CAP) to our non-PEO NEO to (i) the Company’s cumulative TSR; and (ii) the Company’s net income.

All information provided above under the “Pay Versus Performance” heading will not be deemed to be incorporated by reference in any filing by the Company under the Securities Act of 1933, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Director Compensation

The table below summarizes the total cash and non-cash compensation paid or earned during the fiscal year ended December 31, 20212023 by each individual who served as a Company director during the fiscal year ended December 31, 2021.2023.

Name | Fees earned or paid in cash | Stock Awards | Option Awards | Total | Cash Compensation | Stock Awards | Stock Option Awards | Total | |||||||||||||||||||||||||

Chad Hoehne | $ | 0 | $ | 0 | $ | 0 | $ | 0 | |||||||||||||||||||||||||

William Martinez | 20,000 | 0 | 20,000 | 2023 | 23,500 | 0 | 0 | 23,500 | |||||||||||||||||||||||||

Thomas Mertens | 22,000 | 0 | 22,000 | 2023 | 25,500 | 0 | 0 | 25,500 | |||||||||||||||||||||||||

CORPORATE GOVERNANCE MATTERS

Board of Directors and Independence

The Board of Directors has a standing Compensation Committee and Audit Committee, each of which composed of Messrs. Mertens, Martinez and Hoehne (with Mr. Mertens serving as chairperson). The Company also has a Compliance Committee, which is composed of Messrs. Martinez, Randy Sayre (our external compliance consultant) and Chad Hoehne (with Mr. Martinez serving as chairperson). Mr. Siqveland is the Compliance Officer for the Company. Each of the foregoing committees has a written charter, a copy of each of which is available at our website at www.tabletrac.com. The composition of our Audit Committee and Compensation Committee complies with the listing requirements of The NASDAQ Marketplace Rules. The Compliance Committee complies with the rules of the Nevada Gaming Control Board.

The Board of Directors has determined that Messrs. Martinez and Mertens are each “independent,” as such term is defined in Section 5605(a)(2) of the Nasdaq Marketplace Rules, and meet the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended.

Board Leadership Structure and Risk Oversight

Our Board of Directors is led by a Chairman of the Board, Chad Hoehne, and all of our directors (including our independent directors) participate in board leadership. Because a majority of our directors are independent and all of the members of our board participate in leadership, we believe the leadership structure of our Board of Director allows it to maintain oversight of our management and to carry out its roles and responsibilities of behalf of the stockholders.

Management and our Board of Directors discuss risks primarily in our board meetings. These discussions generally identify risks that are prioritized and assigned to the appropriate board committee or the full Board for oversight. Our entire Board of Directors periodically discusses our management or risks. Additional review or reporting on Company risks is conducted as needed or as requested by management, the Board of Directors, a board committee, or any single director.

Board and Committee Meetings

The Board of Directors held fournine formal meetings during fiscal 2021.2023. During fiscal 2021,2023, the Audit Committee held four formal meetings, and the Compensation Committee held fourfive formal meetings while the Compliance Committee met four times. The Board of Directors attended 100% of the board meetings and meetings of committees to which they belong. Although we have no formal policy regarding directors’ attendance at our annual stockholder meetings, we encourage our directors to attend those meetings.

Audit Committee Financial Expert and Related Matters

The Board of Directors has determined that at least one member of the Audit Committee, Mr. TomThomas Mertens, is an “audit committee financial expert” as that term is defined in Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended. Mr. Mertens qualifies as an “independent director,” as such term is defined in Section 5605(a)(2) of the NASDAQ Listing Rules, and meets the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934. The Board of Directors has determined each member of the Audit Committee is able to read and understand fundamental financial statements and that at least one member of the Audit Committee has past experience in finance or accounting matters.

Audit Committee Report

The Audit Committee is responsible primarily for providing oversight and monitoring the preparation and review of our financial statements, which are provided to stockholders and the general public in the disclosures we file with the SEC. In addition, the Audit Committee is responsible for appointing, and reviewing the services of our independent registered public accounting firm.

The Audit Committee does not prepare our financial statements, or determine whether our financial statements are complete and accurate. Rather, our management is responsible for preparing our financial statements. Our independent registered public accountants are responsible for auditing our financial statements.statements to ensure their completeness and accuracy.

The Audit Committee also oversees our accounting policies and the internal controls over financial reporting, which our management is responsible for establishing and maintaining and our independent registered accountants are responsible for reviewing to determine effectiveness.

In fulfilling its oversight over our independent registered public accounting firm, the Audit Committee carefully reviews the engagement of the independent registered public accounting firm, which includes, among other things, the scope of the audit; fees; the assigned partner(s) and other personnel and their industry experience; auditor independence; peer and Public Company Accounting Oversight Board (PCAOB) reviews; significant legal proceedings; previous experience with the firm’s performance; and any non-audit services performed by our independent registered public accounting firm. The Audit Committee meets independently with management, independently with Boulay, P.L.L.P, our independent registered public accountants, and also in executive session with only the Committee members present.

The Audit Committee has reviewed and discussed the audit and the audited financial statements for the year ended December 31, 20212023 with management and Boulay, including a discussion related to the accounting principles used that are unique to this industry. The Audit Committee has discussed with Boulay the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1 AU section 308, as adopted by the PCAOB. The Audit Committee has received and reviewed the written disclosures and the letter from Boulay required by the applicable requirements of the PCAOB regarding Boulay’s communications with the Audit Committee concerning independence, and has discussed with Boulay its independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the financial statements referred to above be included in our Annual Report on Form 10-K for the year ended December 31, 2021.2023.

| ||||||||||||||||

AUDIT COMMITTEE: Thomas Mertens (Chair) William Martinez Chad Hoehne |

Compensation Committee

Our Compensation Committee is charged with oversight responsibility for the adequacy and effectiveness of our executive compensation and benefit plans, and is primarily responsible for all matters relating to compensation of our executive officers and the directors, the adoption of all employee compensation and employee benefit plans and the administration of such plans including granting stock incentives or other benefits, and the review and approval of disclosures regarding executive compensation included in this Proxy Statement. Our Compensation Committee has the authority to obtain advice and assistance from external legal, accounting or other advisors, and has the authority to retain, terminate and approve the fees payable to any external compensation consultant to assist in the evaluation of director, and senior executive compensation. Nevertheless, any services to be rendered by our independent accounting firm must be pre-approved by the Audit Committee under our policy regarding the pre-approval of such services.

Nomination of Directors

The Company does not have a standing nominating committee (or other committee performing similar functions). Based on the size of our Board of Directors, we believe it is appropriate for all of our directors to be involved in the identification and consideration of director nominees. The Company does not employ any charter or other form of official written policy or guidelines for the purposes of considering director-nominees. Nevertheless, when considering director-nominees, the Company recruits and considers candidates without regard to race, color, religion, sex, ancestry, national origin or disability. Generally, the Company will consider each candidate’s business and industry experience, his or her ability to act on behalf of stockholders, overall board diversity, potential concerns regarding independence or conflicts of interest and other factors relevant in evaluating director-nominees. Typically, the candidates will meet with all members of the management team. Management will also consider a candidate’s personal attributes, including without limitation personal integrity, loyalty to the Company and concern for its success and welfare, willingness to apply sound and independent business judgment, awareness of a director’s vital role in the Company’s good corporate citizenship and image, time available for meetings and consultation on Company matters, and willingness to assume broad fiduciary responsibility.

Our stockholders may recommend to the Board of Directors candidates to be considered for election at the Company’s annual stockholders meeting. In order to make such a recommendation, a stockholder generally must submit the recommendation in writing to the Board of Directors, in care of the Company’s Secretary, at the Company’s headquarters address at least 120 days prior to the mailing date of the previous year’s annual meeting proxy statement.

Code of Ethics

The Company has adopted a Code of Ethics that governs the conduct of our officers, directors and employees in order to promote honesty, integrity, loyalty and the accuracy of our financial statements.

Related-Party Transaction Policy

In all cases, the Company abides by applicable state corporate law when approving all transactions, including transactions involving officers, directors or affiliates. More particularly, the Company’s policy is to have any related-party transactions (i.e., transactions involving a director, an officer or an affiliate of the Company) be approved solely by a majority of the disinterested and independent directors serving on the Board of Directors.

Stockholder Communications with Directors

Our Board of Directors has established a means for stockholders and others to communicate with the Board of Directors. If a stockholder has a concern regarding our financial statements, accounting practices or internal controls, governance practices, business ethics or corporate conduct, the concern should be submitted in writing to Mr. Chad Hoehne, CEO, in care of our Secretary at the address listed above. If a stockholder is unsure as to which category the concern relates, the stockholder may communicate it to any independent director in care of our Secretary at the address listed above. All such stockholder communications will be forwarded to the applicable director(s)

Compliance Committee

Although Table Trac has always had a Compliance Officer, with our Nevada licensure, this element has become geometrically more important and demanding. We not only have a Compliance Committee, but we have a Nevada consultant on the committee who was a previous member of the Nevada Gaming Control Board (NGCB). The three-person Committee consists of an outside Board member,Chairman William Martinez, Chad Hoehne, CEO, and our external consultant. In addition, the company’s Compliance Officer (Bob Siqveland), with 40 years’ experience in this capacity, provides a report to the committee every quarter at committee meetings. The Compliance Officer then sends required quarterly and annual reports to various department heads in the Nevada oversight structure to include the NGCB.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of our common stock as of July 28, 2022, April 2,2024 (Record date), by (i) each person known by the Company to be the beneficial owner of more than five percent of our outstanding common stock, (ii) each current director, (iii) each executive officer of the Company and other persons identified as a named executive in the Summary Compensation Table, and (iv) all current executive officers and directors, as well as previous directors, as a group. Percentage ownership is basedbased on 4,621,9884,634,865 shares of our common stock outstanding on the record date.

Unless otherwise indicated, each person or entity named in the table has sole voting power and investment power with respect to the shares set forth opposite his, her or its name. Unless otherwise indicated, the address of each of the following persons is 6101 Baker Road, Suite 206, Minnetonka, Minnesota 55345.

Common Shares | Percentage of | |||||||

Beneficially | Common | |||||||

Name and Address | Owned (1) | Shares (1) | ||||||

Chad Hoehne (2) | 1,171,600 | 26.00 | % | |||||

Randy Gilbert (3) | 65,225 | 1.50 | % | |||||

Robert Siqveland (4) | 206,500 | 4.58 | % | |||||

William Martinez(5) | 2,000 | * | ||||||

Thomas Mertens(6) | 2,000 | * | ||||||

All directors and officers as a group (7) | 1,447,325 | 32.17 | % | |||||

Zeff Capital, LP (8) 1601 Broadway, 12th floor | 450,000 | 9.94 | % | |||||

Common Shares | Percentage of | |||||||

Beneficially | Common | |||||||

Name and Address | Owned(1) | Shares(1) | ||||||

Chad Hoehne(2) | 1,159,100 | 25.08 | % | |||||

Randy Gilbert(3) | 82,725 | 1.79 | % | |||||

William Martinez(4) | 2,000 | * | ||||||

Thomas Mertens(5) | 2,000 | * | ||||||

All directors and officers as a group(6) | 1,245,825 | 26.95 | % | |||||

Zeff Capital, LP(7) 1601 Broadway, 12th floor New York, NY 10019 | 450,000 | 9.74 | % | |||||

* denotes less than one percent.

(1) | Beneficial ownership is determined in accordance with the rules of the SEC, and includes general voting power and/or investment power with respect to securities. Under the applicable SEC rules, each person’s beneficial ownership is calculated by dividing the total number of shares with respect to which they possess beneficial ownership by the total number of outstanding shares of the Company. In any case where an individual has beneficial ownership over securities that are not outstanding, but that are issuable upon the exercise of options or warrants or similar rights within the next 60 days, that same number of shares is added to the denominator in the calculation described above. Because the calculation of each person’s beneficial ownership |

(2) | Mr. Hoehne is the |

|

|

(3) | Mr. Gilbert is the Company’s Chief Financial Officer and Chief Operation Officer. |

(4) | Mr. |

(5) | Mr. |

(6) |

|

| Consists of |

| Share figures reflected in the table are based on a Schedule 13-G filing with the SEC made by Zeff Capital, LP (and Zeff Holding Company, LLC, and Daniel Zeff), which is the Company’s best available information relating to Zeff Capital’s ownership of Company common stock. Based on the referenced filing, voting and dispositive power with respect to these shares is exercised by Zeff Capital, LP. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers, directors and persons considered to be beneficial owners of more than ten percent of a registered class of the Company’s equity securities to file reports of ownership and changes in ownership with the Securities and Exchange Commission and NASDAQ.Commission. Officers, directors and greater-than-ten-percent stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on a review of the copies of such forms furnished to the Company by its officers and directors, or the Company’s actual knowledge of transactions involving such officers and directors, the Company believes that all such filings were filed on a timely basis for fiscal year 2021.2023.

RATIFICATION OF THE APPOINTMENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

(Proposal Two)

Our Board of Directors is committed to the quality, integrity and transparency of the Company’s financial reports. Independent auditors play an important part in our system of financial control. Our Board of Directors and its Audit Committee has appointed Boulay P.L.L.P. (“Boulay”) as our independent registered public accounting firm for the fiscal year ending December 31, 2022.2024. A representative of Boulay is expected to attend the Annual Meeting and will be available to make statements and respond to questions from stockholders.

If the stockholders do not ratify the appointment of Boulay, the Board of Directors and Audit Committee may reconsider its selection, but is not required to do so. Notwithstanding the proposed ratification of the appointment of Boulay by the stockholders, the Board of Directors and Audit Committee may, in their discretion, direct the appointment of a new independent registered public accounting firm at any time during the year without notice to, or the consent of, the stockholders, if the Board of Directors or Audit Committee determines that such a change would be in the best interests of the Company.

Fees Billed to Company by Independent Registered Public Accounting Firm

The following table details the fees billed to the Company by Boulay in 20202023 and 2021:2022:

2020 | 2021 | 2023 | 2022 | |||||||||||||

Audit fees, | $ | 95,000 | $ | 97,900 | ||||||||||||

Audit fees, including quarterly review of Form 10-Q | $ | 137,100 | $ | 110,900 | ||||||||||||

Tax fees | 12,916 | 12,500 | 12,500 | 9,800 | ||||||||||||

Audit-related fees | 15,010 | 22,800 | 10,600 | 18,500 | ||||||||||||

All other fees | 0 | 0 | ||||||||||||||

| $ | 122,926 | $ | 133,200 | $ | 160,200 | $ | 139,200 | |||||||||

(1) | Audit Fees consist of fees for professional services rendered for the audit of our consolidated annual financial statements included in our annual report, and review of the interim consolidated financial statements included in quarterly reports, and services that are normally provided in connection with statutory and regulatory filings or engagements. Includes amounts reflected on invoices received in |

(2) | Tax Fees consist of fees for professional services rendered for tax compliance, tax advice and tax planning. |

(3) | Audit-Related Fees consist of fees for professional services rendered that reasonably related to the performance of the audit or review of our consolidated financial statements but not reported under the “Audit Fees” category. This category may include fees related to the performance of audits and attestation services not required by statute or regulations, and accounting consultations about the application of generally accepted accounting principles to proposed transactions. |

|

|

|

|

The Board of Directors has reviewed the services provided by Boulay during the fiscal year ended December 31, 2021,2023, and the amounts billed for such services. After consideration, the Board of Directors has determined that the receipt of these fees by Boulay is compatible with the provision of independent audit services. The Audit Committee has discussed these services and fees with Boulay management to determine that they are appropriate under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as under guidelines of the American Institute of Certified Public Accountants.

Pre-Approval Policy

The Audit Committee is responsible for appointing, setting compensation for and overseeing the work of our independent registered public accounting firm. The Audit Committee has established a policy for pre-approving the services provided by our independent registered public accounting firm in accordance with the auditor-independence rules of the SEC. This policy requires the review and pre-approval by the Audit Committee (or the full Board of Directors) of all audit and permissible non-audit services provided by our independent registered public accounting firm and an annual review of the financial plan for audit fees. During fiscal 2020, 100% of the audit-related and tax services provided by our independent registered public accounting firm were pre-approved by our Audit Committee in conformity with its pre-approval policy.

To ensure that auditor independence is maintained, the Audit Committee annually pre-approves the audit services to be provided by our independent registered public accounting firm and the related estimated fees for such services, as well as the nature and extent of specific types of audit related, tax and other non-audit services to be provided by our independent registered public accounting firm.

The Board of Directors recommends a vote FOR the ratification of the Company’s independent registered public accounting firm.

ADVISORY VOTE ON EXECUTIVE COMPENSATION

(Proposal Three)

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) was signed into law on July 21, 2010. The Dodd-Frank Act requires that our stockholders be provided an opportunity to cast a separate advisory vote on the compensation paid to our executive officers as disclosed in this Proxy Statement.

The Company has designed its executive compensation program to attract, motivate, reward and retain the senior management talent required to achieve our corporate objectives and to increase long-term stockholder value.

This proposal, commonly known as a “say-on-pay” proposal, gives you as a stockholder the opportunity to vote on the compensation of our executive officers through the following resolution:

“RESOLVED, that the stockholders of Table Trac, Inc., approve the compensation of its executive officers as described in the Proxy Statement for its 2022 Annual Meeting.”

Under the Dodd-Frank Act, your vote on this matter is advisory and will therefore not be binding upon the Board of Directors. However, the Compensation Committee of the Board of Directors will take the outcome of the vote into account when determining further executive compensation arrangements.

THE BOARD RECOMMENDS THAT SHAREHOLDERS VOTE FOR APPROVAL OF THE EXECUTIVE COMPENSATION DISCLOSED IN THIS PROXY STATEMENT.

STOCKHOLDER PROPOSALS AND

DISCRETIONARY PROXY VOTING AUTHORITY

Any stockholder desiring to submit a proposal for action by the stockholders at the next annual stockholders’ meeting, which will be the 20232024 annual meeting, must submit that proposal in writing to the Secretary of the Company at the Company’s corporate headquarters no later than November 11, 202208, 2024 to have the proposal included in the Company’s proxy statement for that meeting (unless the date of the Company’s 20232024 annual meeting of stockholders varies more than 30 days from July 14, 2022,May 15, 2025, in which case a stockholder proposal is due a reasonable amount of time prior to when the Company begins to print and mail its proxy statement for that meeting). Due to the complexity of the respective rights of the stockholders and the Company in this area, any stockholder desiring to propose such an action is advised to consult with his or her legal counsel with respect to such rights. The Company suggests that any such proposal be submitted by certified mail, return-receipt requested.

Rule 14a-4 promulgated under the Securities Exchange Act of 1934 governs the Company’s use of its discretionary proxy voting authority with respect to a stockholder proposal that the stockholder has not sought to include in the Company’s proxy statement. Rule 14a-4 provides that if a proponent of a proposal fails to notify the Company at least 45 days prior to the month and day of mailing of the prior year’s proxy statement, then management proxies will be allowed to use their discretionary voting authority when the proposal is raised at the meeting, without any discussion of the matter.

SOLICITATION

The Company will bear the cost of preparing, assembling and mailing the proxy, Proxy Statement, Annual Report and other material that may be sent to the stockholders in connection with this solicitation. Brokerage houses and other custodians, nominees and fiduciaries may be requested to forward soliciting material to the beneficial owners of stock, in which case they may be reimbursed by the Company for their expenses in doing so. Proxies are being solicited primarily by mail. Nevertheless, officers and employees of the Company may solicit proxies personally, by telephone, by special letter, or via the Internet.

The Board of Directors does not intend to present to the meeting any other matter not referred to above and does not presently know of any matters that may be presented to the meeting by others. If, however, other matters come before the meeting, it is the intent of the persons named in the enclosed proxy to vote the proxy in accordance with their best judgment.

By Order of the Board of Directors:

Randy W. Gilbert Secretary | |||